What makes Bit-Maker outstanding?

Stable Service System

In 2022, Bit-Maker successfully hedged positions exceeding $50 billion, demonstrating our stable and robust hedging capabilities. Our professional team is available 24/7, ready to address any issues and provide assistance, ensuring reliable support for your operations.

Efficient Product Architecture

Bit-Maker offers comprehensive functionality that covers all aspects of exchange operations, enabling seamless management of 1500+ trading pairs. Our efficient and user-friendly admin panel significantly enhances operational efficiency, allowing for streamlined and effective management.

Exceptional Real-time Pricing

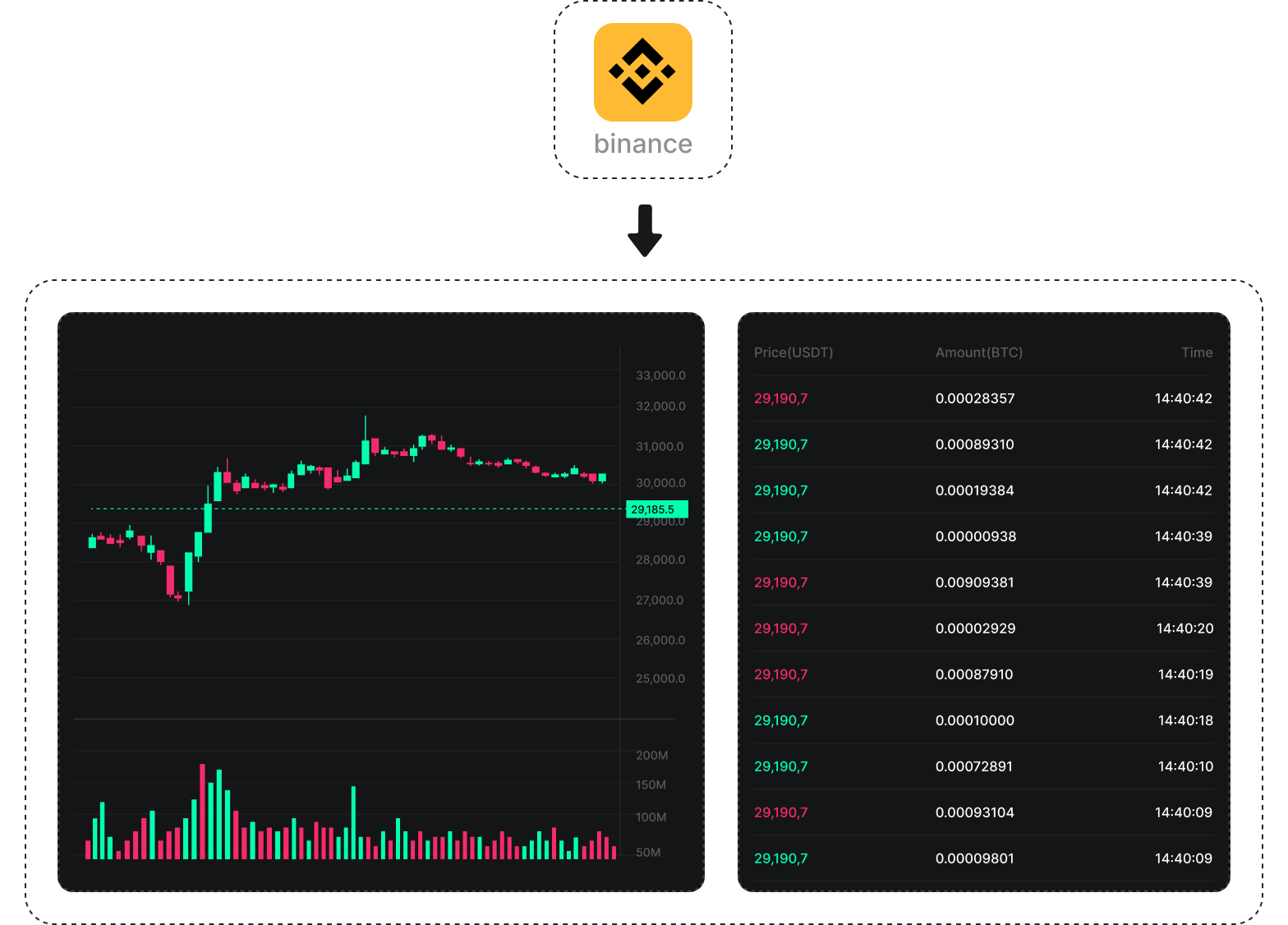

With Bit-Maker, the time from receiving market updates from Binance to order submission to the exchange is just 30 milliseconds, ensuring the timeliness of your quotes. This exceptional real-time pricing capability allows you to stay ahead of market movements and seize trading opportunities.

Diverse Asset Type Support

Bit-Maker offers comprehensive asset liquidity management, supporting various asset types such as spot trading, USDs-M contracts, COIN-M contracts, and leveraged tokens (limited to CHAINUP exchange system). We provide precise and effective services across these asset types, ensuring optimal liquidity management for your trading needs.

Complete Coin Pair Coverage

With Bit-Maker, you can provide mirror pricing for 90% of the coin pairs in the market. We offer professional services for any coin pair supported by Liquidity Provider exchanges, ensuring comprehensive coverage and liquidity for your trading needs.

Flexible Service Models

Self-Operated or Fully-Managed: Choose to independently operate and manage your liquidity or rely on our comprehensive services, allowing you to focus on your core business.

Bit-Maker Features

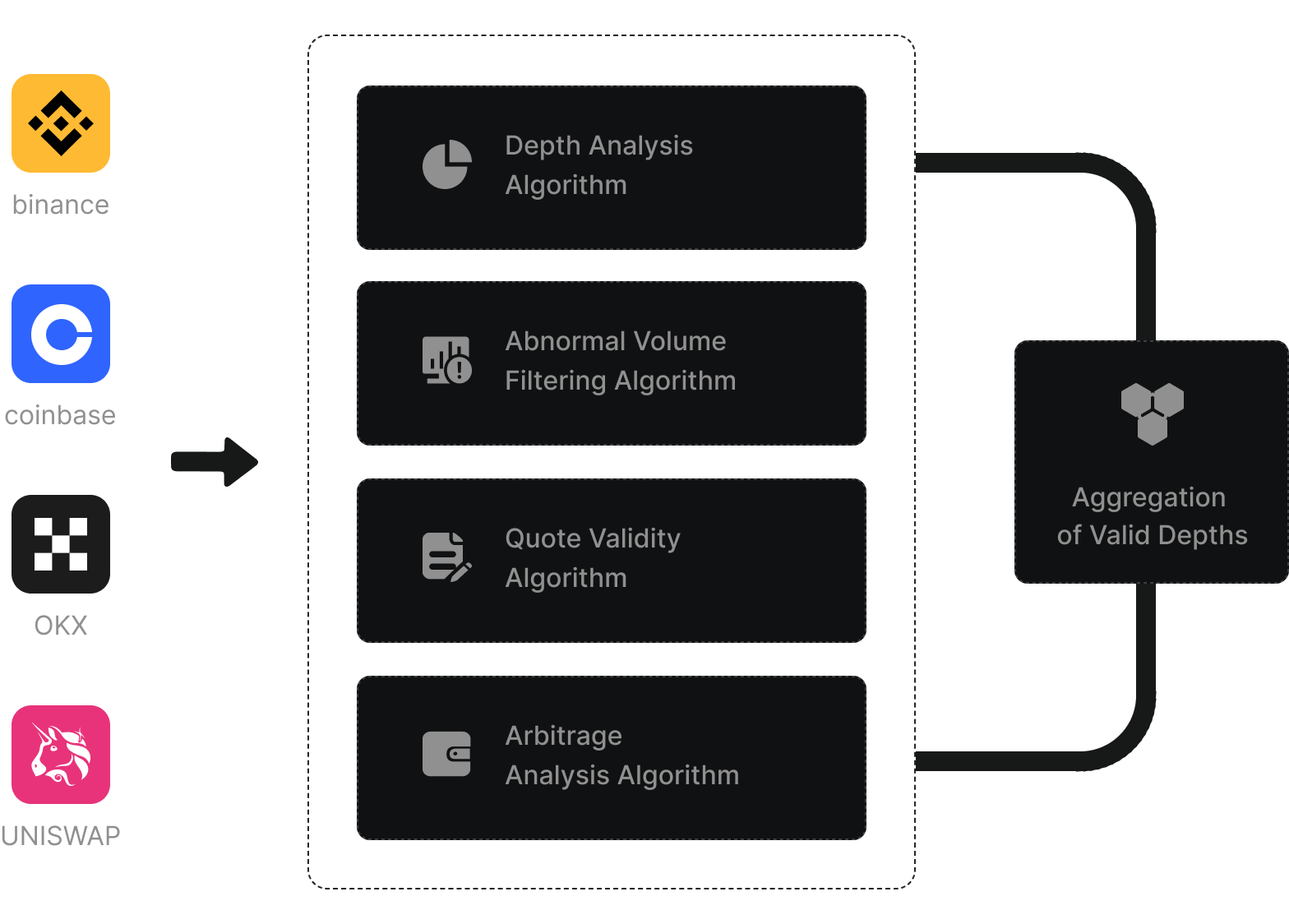

Quote Aggregator

The role of a Quote Aggregator is to consolidate valid orders from multiple markets into a single order book. By aggregating these valid orders, an exchange can access higher-quality liquidity from the Quote Aggregator and execute trades at more competitive prices. This allows the exchange to improve its liquidity offering and provide better execution for its users.

Replication Engine

The Volume-Price Replication Engine enables the replication and synchronization of volume and price data across multiple markets. With this engine, exchanges can replicate the trading volume and prices from one market to others, ensuring real-time data synchronization and consistency. This provides a more accurate and comprehensive market data and trading execution environment.

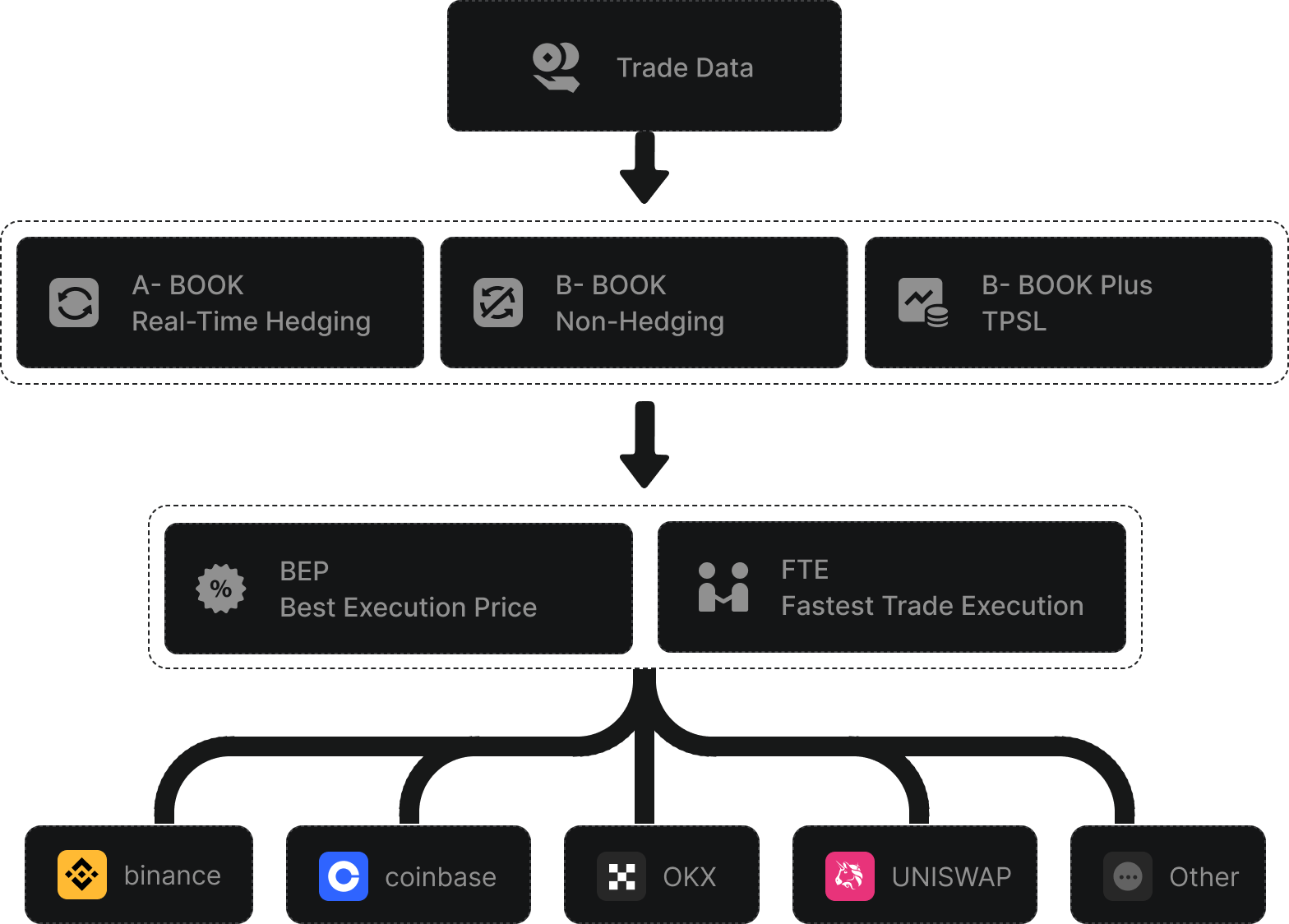

Smart Hedging Router

Smart Hedging Router is a comprehensive tool that combines Hedging Strategy Engine and Order Strategy Engine. Its main function is to gather order execution data and select the best route for position hedging based on predefined strategy factors. By optimizing hedging strategies and order execution strategies, Smart Hedging Router aims to achieve optimal hedging results and risk control, thereby improving the quality of liquidity and market-making efficiency.

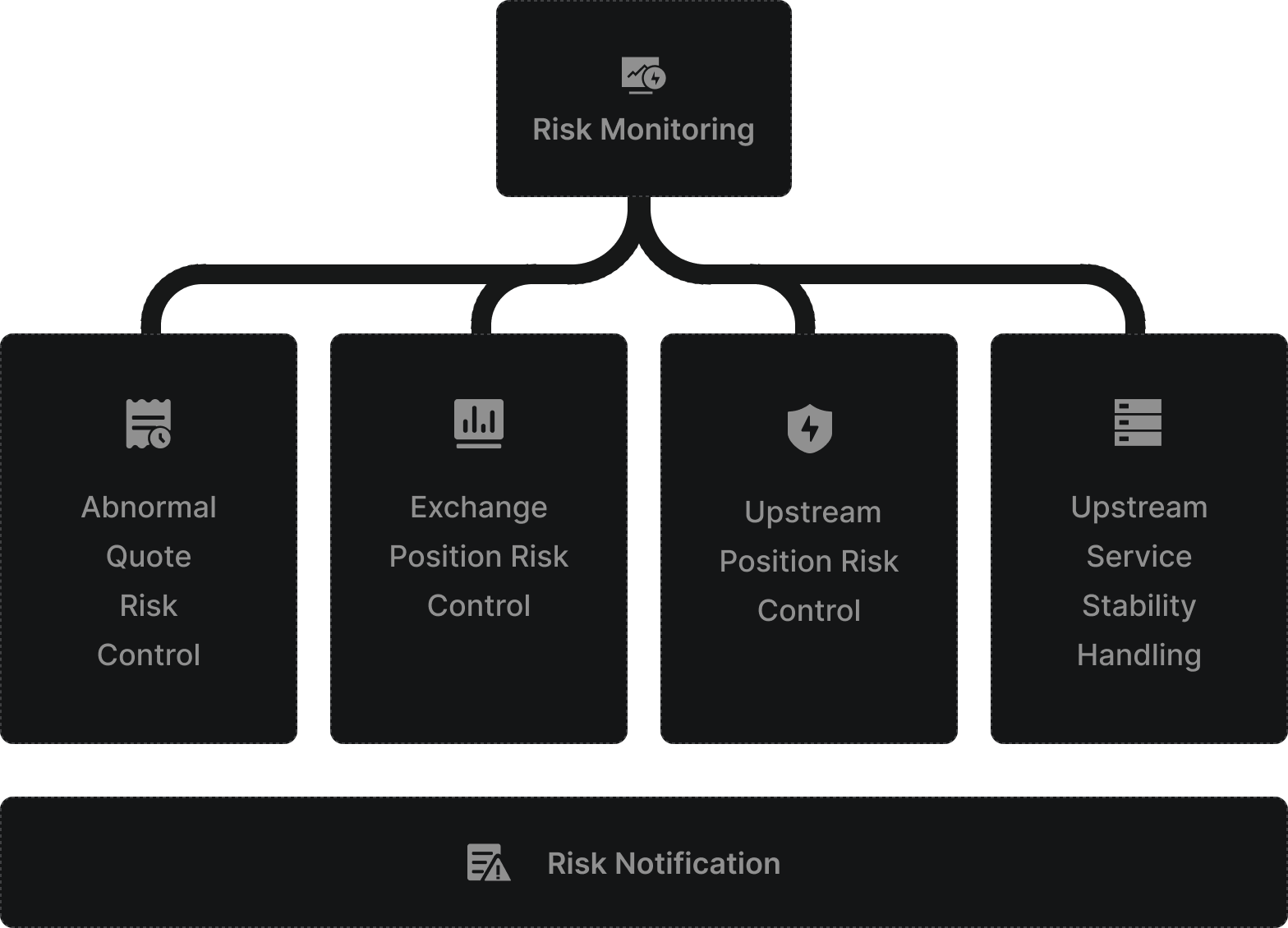

RCS (Risk Control System)

Risk Control System (RCS) is comprised of three modules: Risk Monitoring, Risk Handling, and Risk Notification. It monitors and handles risks related to quotes, positions, and services upstream and downstream, and timely communicates the handling results through the notification module. Particularly, it provides automated anti-crash functionality for upstream services to ensure service reliability. The risk control system comprehensively manages and handles risks, protecting the interests of exchanges and traders, and enhancing the security and stability of the trading environment.

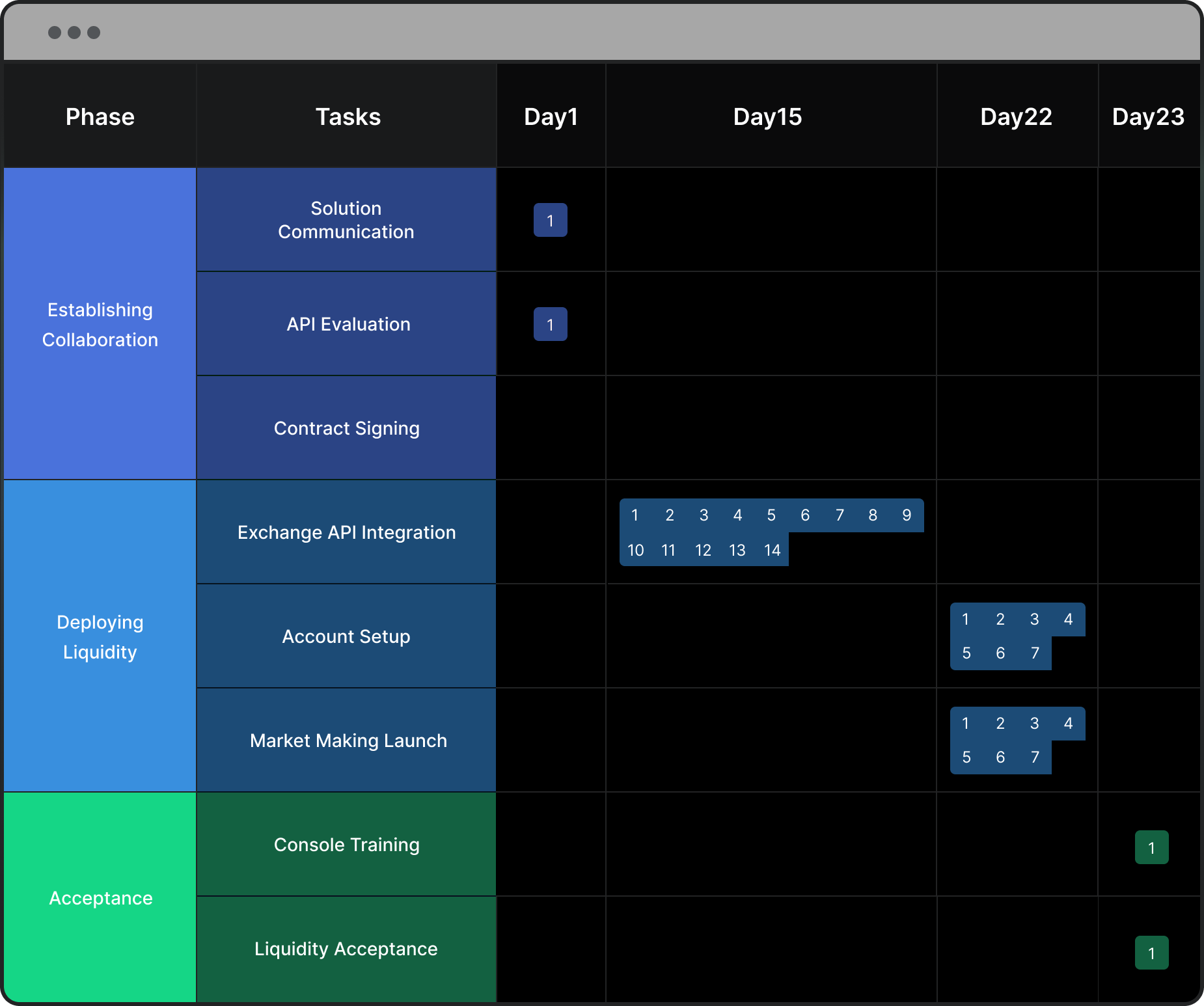

Pricing Plans and Service Process

Bitwind is committed to catering to diverse needs with a range of plans. Whether your exchange is in any stage of the market, you can find a suitable plan with Bitwind. If the current plans do not meet your goals, please let us know through the contact form, and our liquidity team will get in touch with you promptly.Annual Expenses: Subscription fee

Q&A

View More

Choose Bitwind

With the world's top institutions

Drive business together